What Peloton’s $1.2B Valuation Signals to Fitness Equipment Manufacturers

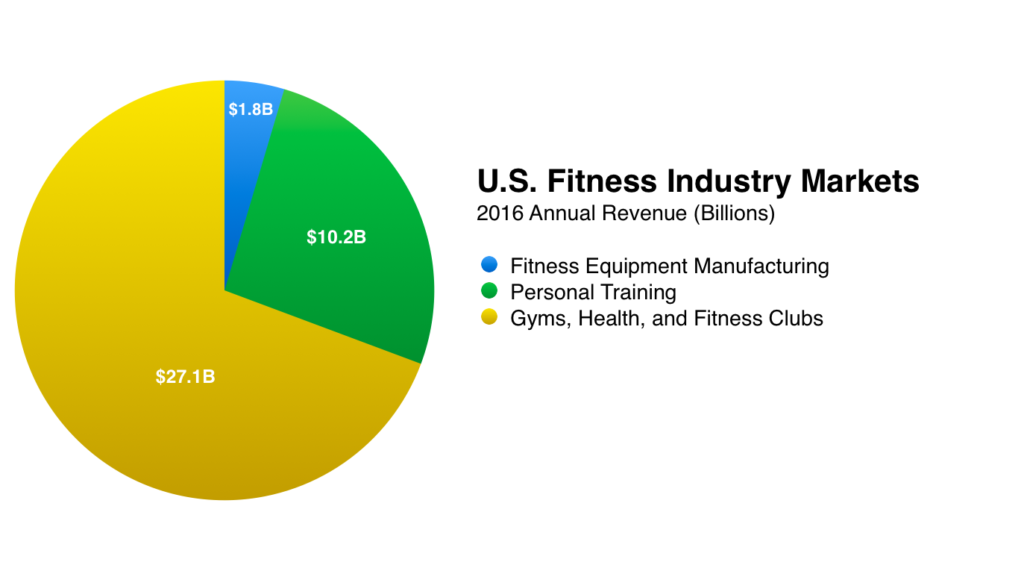

Peloton sells a connected spin bike for $1,995 and streaming classes for $39/mo. They are raising at a $1.2B valuation on $160M in annual sales, which is catching a lot of attention from fitness equipment manufacturers. The obvious question: How is it possible for any fitness equipment company to be valued at $1.2B when total industry sales in the U.S. were $1.8B in 2016?

To answer that question, let’s zoom out and take a broader view of the $40B U.S. fitness industry. Fitness equipment manufacturing sits directly adjacent to the $10.2B personal training and the $27.1B fitness club industries:

Peloton uses basic, elegant technology to capture value in bigger, adjacent markets by selling coaching and fitness experiences. Their success provides a model for fitness equipment manufacturers to capture value outside the constraints of the smaller, $1.8B fitness equipment manufacturing business, and migrate into the larger, $36B market currently occupied by trainers and fitness clubs.

For manufacturers who sell into the home market, this is a no brainer. Consumers have clearly signaled that they are ready to pay for coaching and classes alongside their equipment. The additional services actually make the hardware more valuable, because they increase the chances that it will be used and used correctly.

“But this model only works in a direct-to-consumer market,” you might argue, “commercial fitness equipment manufacturers operate in a more complex value chain.” And you’re right. Trainers and clubs buy lots of fitness equipment. Stealing share from customers is a bad sales strategy, so it’s important that new commercial fitness technologies help trainers and clubs.

Fortunately, next-generation fitness technology will be used to solve the biggest problem that has plagued trainers and clubs for decades: Since they’re stuck doing a lot of manual, repetitive work, trainers don’t scale.

Trainers and fitness clubs have a big problem: They don’t scale. With low barriers to entry competition is always high and most trainers have really hard time earning a living. The average personal trainer makes about $33k per year and only 8% are salaried, so the income can be unpredictable. Trainers got stuck a dual role of trainer and salesperson – almost nobody is good at both. The administrative and repetitive nature of teaching new folks how to work out, tracking them, and providing accountability makes it hard to build community and sell higher value services in any sustainable way. They get burned out. The average workout with a trainer is out of reach for most consumers at $56 per workout, so only 12% of active gym users use a trainer.

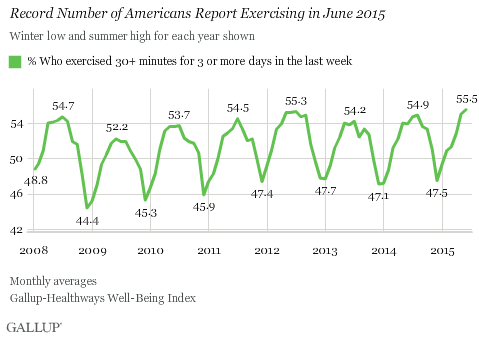

The limited ability of trainers and clubs to provide a delightful service in a scaleable way constrains the growth of the fitness market. Most people wing it, which is a big reason the fitness industry has been stuck with the same low participation rates for as long as they’ve been measured.

Technology – especially elegant, thoughtfully designed technology – offers personalization at scale. When consumers have better options, the market grows, and technology innovators are the ones who capture an outsize share of the new market growth. Apple’s entry into the adjacent phone industry is an apt comparison. Apple’s technology grew the market for wireless carriers while upending traditional industry power structures. By delighting the end customer, Apple ushered in a new golden era for the entire industry. The only companies that suffered were less tech-savvy manufacturers (e.g. Nokia).

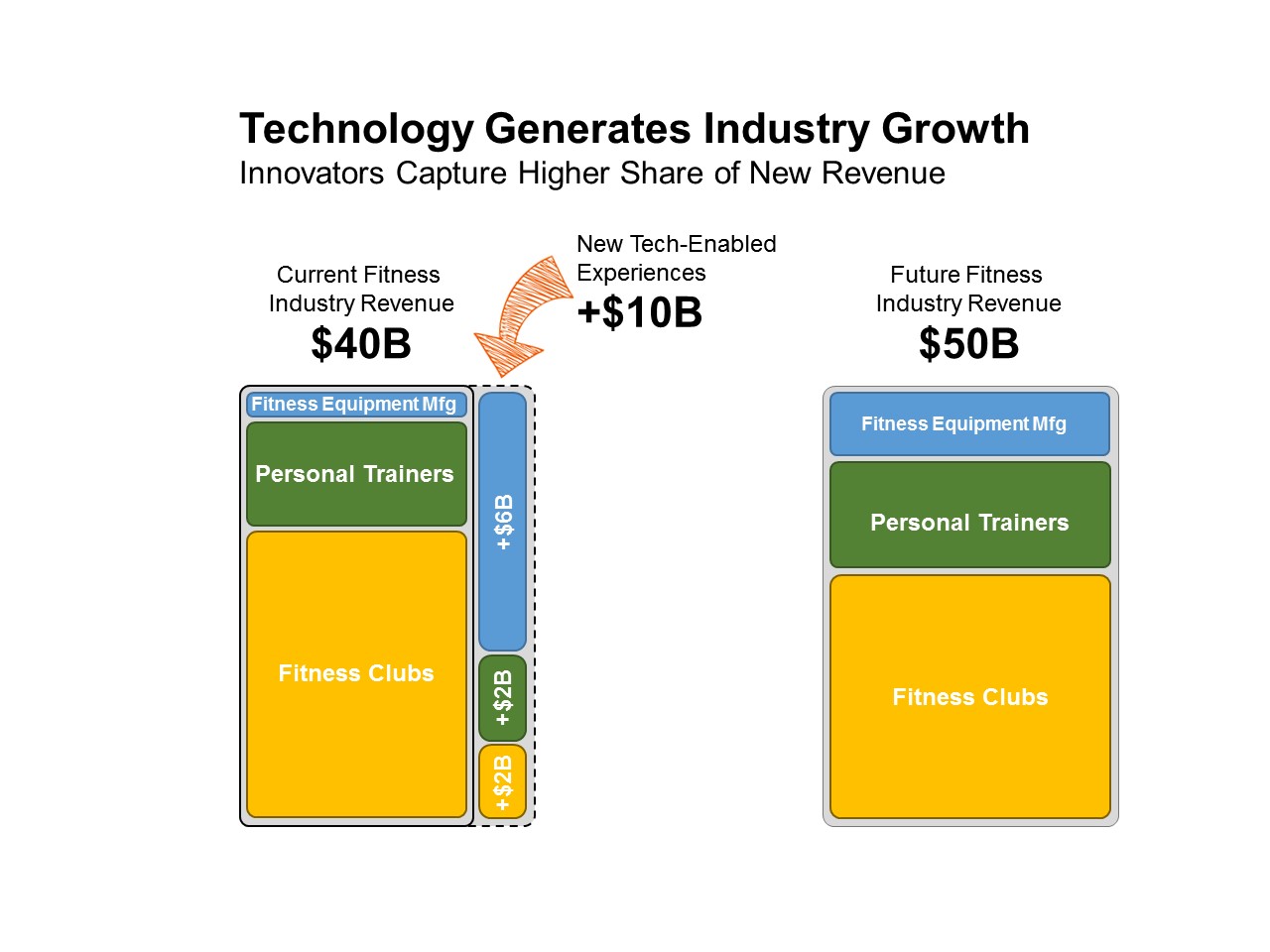

Fitness equipment manufacturers are best positioned to bring new fitness technology to the market. Trainers and clubs aren’t trained or staffed to be technology companies, so fitness equipment manufacturers have always led the way on innovation. By bringing the next generation of technology to the market and helping trainers and clubs provide more scaleable, personalized experiences, fitness equipment manufacturers will capture a disproportionately high share of the incremental value that is created:

Peloton’s $1.2B valuation signals to fitness equipment manufacturers that it’s possible to capture value in larger, adjacent markets without harming existing customers. Technology will never replace the community of a fitness club, but it can create new ties to bind that community together. Fitness equipment manufacturers can grow the industry and improve the lives of trainers and fitness clubs by creating the tools that make personalized fitness experiences more available.

Our team is motivated to help fitness equipment manufacturers capitalize on this opportunity. It’s a big opportunity, and now is the time.